|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

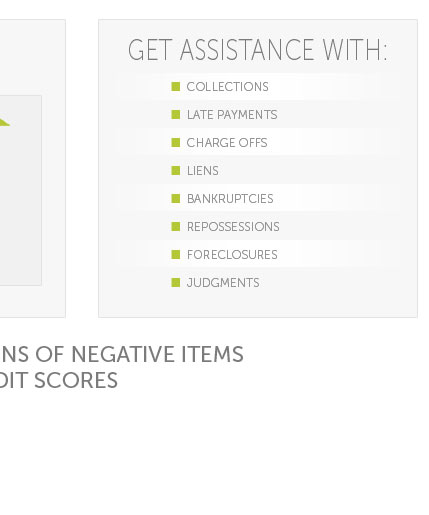

Unlock the door to financial freedom with our expert credit repair services, where we don't just mend your credit score, we transform it-say goodbye to financial limitations and hello to endless possibilities as we dive deep into personalized strategies to erase negative marks, optimize your payment history, and unleash the power of smart credit utilization, all while empowering you with the knowledge and tools to maintain a stellar score; it's not just about numbers, it's about regaining control of your financial destiny with confidence and ease.

https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/how-to-fix-a-bad-credit-score/

You can fix a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a ...

You can fix a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a ...

https://www.careervillage.org/questions/918493/how-do-i-build-up-and-keep-a-good-credit-score

HARRIETTE's Answer - 1. Make Timely Bill Payments Your payment history is the most influential factor in your credit score. - 2. Don't Max Out ...

HARRIETTE's Answer - 1. Make Timely Bill Payments Your payment history is the most influential factor in your credit score. - 2. Don't Max Out ...

https://www.myfico.com/credit-education/improve-your-credit-score

Reduce the amount of debt you owe - Keep balances low on credit cards and other revolving credit - Pay off debt rather than moving it around - Don't close ...

Reduce the amount of debt you owe - Keep balances low on credit cards and other revolving credit - Pay off debt rather than moving it around - Don't close ...